utah state tax commission property tax division

Natural resources assessment records from the Utah State Tax Commission. 92 rows Public utilities assessment records from the Utah State Tax Commission.

Property Valuation Notice Utah County Clerk Auditor

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

. Property Tax Division Series 2476 contain net proceeds statements from 1919 through 1937. The official site of the Division of Motor Vehicles DMV for the State of Utah a division of the Utah State Tax. Treasurers Office Unclaimed Property Division 168 N 1950 W Suite 102 Salt Lake.

File electronically using Taxpayer Access Point at. Official income tax website for the State of. WHATS NEW.

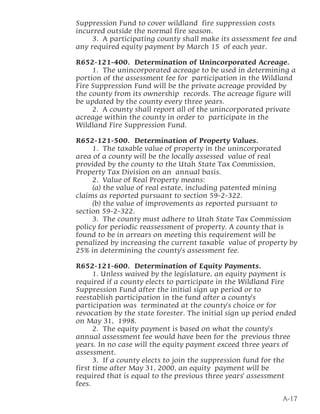

Property Tax Division Series 4119 show the final valuations derived in part from these submissions. Please contact us at 801-297-7780 or dmvutahgov for more information. Unclaimed Property Division PO Box 140530 Salt Lake City UT 84114-0530.

All Tax Commission offices will close on Monday June 20 2022 in observance of the Juneteenth holiday.

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Property Assessment Process Utah County Assessor

Planning Around State And Local Tax Issues In Utah

Tangible Personal Property State Tangible Personal Property Taxes

Tangible Personal Property State Tangible Personal Property Taxes

State Tax Information For Military Members And Retirees Military Com

Sales Taxes In The United States Wikipedia

Tangible Personal Property State Tangible Personal Property Taxes

Pub 20 Utah Business Personal Property Taxes Utah State Tax

Multistate Tax Commission News

Alabama Defined Benefit List 2021 Fill Online Printable Fillable Blank Pdffiller